Bank cards and signature loans are unsecured loans. This suggests they aren't backed by any collateral. Unsecured loans usually have larger fascination rates than secured loans because the hazard of default is higher than secured loans.

Our editors are devoted to bringing you impartial ratings and information. Advertisers tend not to and can't impact our scores.

NerdWallet’s evaluate procedure evaluates and charges particular loan solutions from more than 35 money technologies corporations and monetary establishments. We accumulate above fifty information factors and cross-Verify company Web-sites, earnings reviews and also other public files to substantiate products aspects.

It is still doable to qualify for loans For those who have plenty of credit card debt or perhaps a poor credit history score, but these will probably come with a better desire price. Considering the fact that these loans tend to be dearer In the end, you happen to be significantly better off trying to help your credit history scores and financial debt-to-profits ratio.

Our qualified reporters and editors convey the news and Assessment you will need—backed by data and firsthand working experience.

Financial institutions in some cases demand you to go to a local branch in individual to close on the loan, plus some banking institutions, like Wells Fargo, only supply loans to existing shoppers.

A shorter-phrase loan implies you’ll pay back considerably less interest, even though a longer repayment expression provides reduced every month payments. Determined by your budget, one particular may make more financial feeling than the other.

Personal loans online are easy to apply for because you gained’t have to become a member of the credit rating union or lender so as to qualify. Mainly because everything is completed on line, on line lenders often just take considerably less time for you to approve and fund your individual loan.

Property fairness loans - These consider out a line of credit rating on your house and might set you in a tough problem if down akhuwat the road you will be struggling to pay it back again

For larger loans, they may need collateral, like real estate property or maybe a auto. In the event the borrower defaults around the loan, these property could be seized to pay back the remaining debt.

The presents that seem On this desk are from partnerships from which Investopedia receives compensation. This payment might affect how and wherever listings seem. Investopedia won't contain all offers offered in the marketplace.

What exactly is a Loan? The expression loan refers to a sort of credit rating auto by which a sum of cash is lent to another social gathering in Trade for potential repayment of the worth or principal sum.

If none of those possibilities are feasible to suit your needs, understand that it is possible to constantly go in your bank for just a loan. Just bear in mind that almost all major credit history lenders and institutions are hesitant to lend out funds when you have terrible credit rating. Deciding on an alternate route might show for being a lot more effective in the end.

With compounding, the interest owed is increased than that of The easy desire technique due to the fact desire is charged regular monthly over the principal loan quantity, which include accrued interest from your past months.

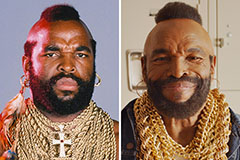

Mr. T Then & Now!

Mr. T Then & Now! Bug Hall Then & Now!

Bug Hall Then & Now! Andrew McCarthy Then & Now!

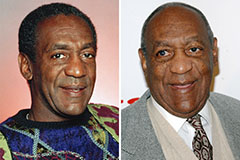

Andrew McCarthy Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now! Rossy de Palma Then & Now!

Rossy de Palma Then & Now!